Health Care Options: Using a Flexible Spending Account FSA

- Dr. Mordeana Williams

- Jul 3, 2022

- 2 min read

What is flexible spending?

It is a savings account that works for you, using your pre-tax money that is deducted at time of payroll. A Health Savings Account (HSA) also known as Flexible Spending works to allow you to pay for health care expenses not covered by insurance.

Examples. Your Co-pays, Deductibles, Prescriptions, Vitamins, Minerals, Dental, Vision and many other health care products using pre-tax dollars.

The employee may determine how much money, if any, they want to set aside. This will provide you with a debit card that allows you to pay for qualified medical expenses directly from your HSA account.

This helps to offset your High Deductible Health Plan (HDHP) out of pocket costs. Some companies will contribute towards your HSA. Those employee do not need to made contributions to receive this benefit, however, they do need to set up an account to receive the HSA debit card. You may check with your company to see their Benefits and Enrollment Guide for the annual contribution amount.

You must be enrolled in the plan and meet eligibility requirements

Depending on the company the funds may or may not be carry over from year to year.

The employee may determine how much money, if any, they want to set aside through payroll deductions on a pre-tax basis.

FSA (Flexible Savings Account) for Health Care Expenses:

$1,000.00 per year maximum annual contribution

Minimum deposit $100 per year

Employees may begin to use funds as of January 1 and will not be required to wait for funds to be accumulated.

A debit card will be issued to each enrollee

In some cases depending on you your company employees may now roll over up to $500.00 that was not reimbursed in the previous calendar year. Anything over $500.00 is forfeited.

Some companies allow the employee to pay for eligible elder care or child care expenses, including daycare, before and after school care and summer day camp expenses, with pre-tax dollars.

One Company Example

$5,000 maximum annual contribution (IRS)

Minimum deposit $100 per year

Funds may only be used for daycare expenses for children 13 and under.

Employees may only receive reimbursement for funds that have accumulate

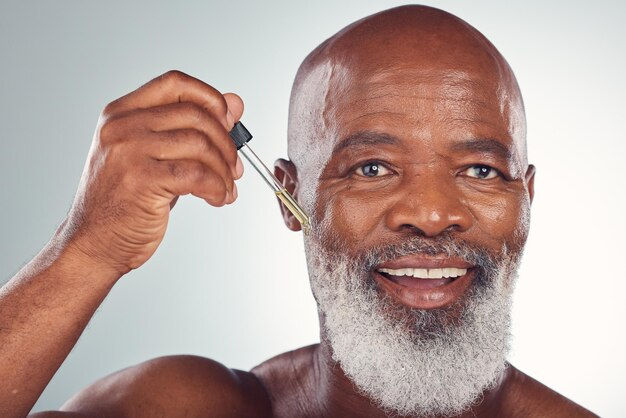

Flexible Spending is accepted for payment at VitaMineral IV Therapy Med-spa for all your treatments. Why wait to use the money you already have. If you are looking for ways to really benefit from IV Vitamin therapy and other treatment please call for an appointment or book a treatment on our website. www.Vitamineralivtherapy.com.

Comments